Key elements of spring investment climate

The coming March will become a turning point for the world economy.

The investment climate in the near future will be determined primarily by three key events: geopolitics, easing the pressure of COVID-19 in most countries of the world, and monetary policy measures.

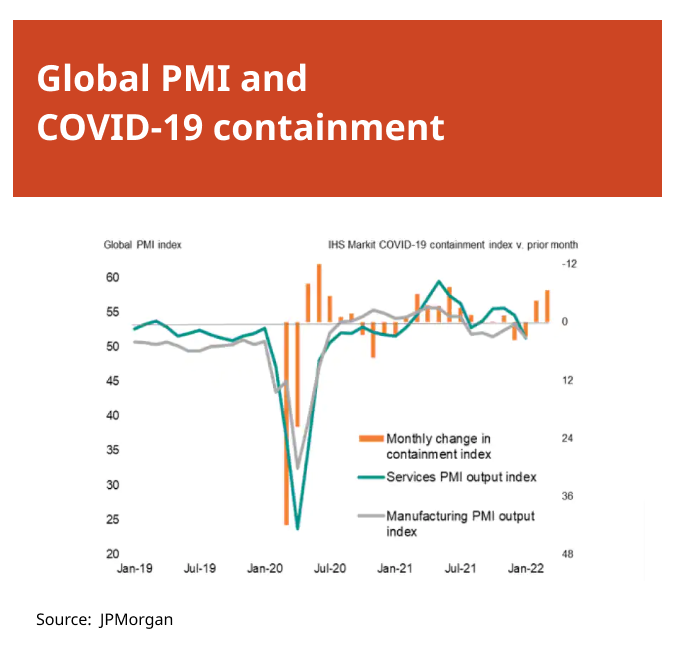

The virus is retreating. In the countries of Europe and North America, social restrictions are being lifted, the economy is reopening. Delivery times are improving, promising less disruption to supply chains.

In 6 out of 7 G7 countries, the economy shows improvement. The exception is Japan. Here, at the end of January, new social services were introduced, which operated until mid-February.

In February, the PMI business activity index was below the 50 level for the second consecutive month. Services PMI surpassed the manufacturing PMI in the UK and France, another sign of a post-COVID recovery.

The normalization of monetary policy will take a big step forward in the coming weeks with the first interest rate hikes in the US and Canada and the first balance sheet cuts by the Bank of England. The European Central Bank will update its asset purchase outlook and is expected to allow an increase towards the end of the year.

The Bank of Japan's 0.25% cap rate to control the 10-year yield curve could be challenged if global yields pick up. The Reserve Bank of Australia continues to resist expectations of an early rise, which the swap market says, is likely to happen in July.

Commodity prices continue to rise. The CRB index rose about 3.5% in February after rising 9.8% in January.

Oil prices remain near multi-year highs, and the WTI April contract is up about a quarter this year. It seems that the maximum has not yet arrived.

U.S. natural gas prices have risen about 20% this year, but partly because of a weak finish last year. However, it is above the 200-day moving average by about 4%. The European benchmark (Netherlands) rose almost 40%. Higher oil and natural gas prices have an indirect impact on food production from fertilizers and pesticides, not to mention transportation. Note that the doubling of oil prices preceded the last three recessions in the US. The price of WTI has doubled since the beginning of last year.

Emerging markets were resilient at the beginning of the year. Brazil and Russia have been particularly aggressive in raising rates in 2021 and earlier this year.

The Bannockburn GDP-weighted foreign exchange index rose about 0.3% in February as currencies tended to appreciate against the dollar. The Chinese yuan (21.8%) and the euro (19.1%) have the largest weight after the US dollar (31%) in the index. They rose by 0.7% and 0.3% respectively. The best performer in the index was the Brazilian real (2.1% weighting) with a 3.0% gain, followed by the Australian dollar (2.0% weighting) with a 2.25% gain.